financial empowerment & problem solving (FEPS)

For the 2022-23 fiscal year, our main objective was to consistently deliver an outstanding financial counselling and tax filing service to our community residents.

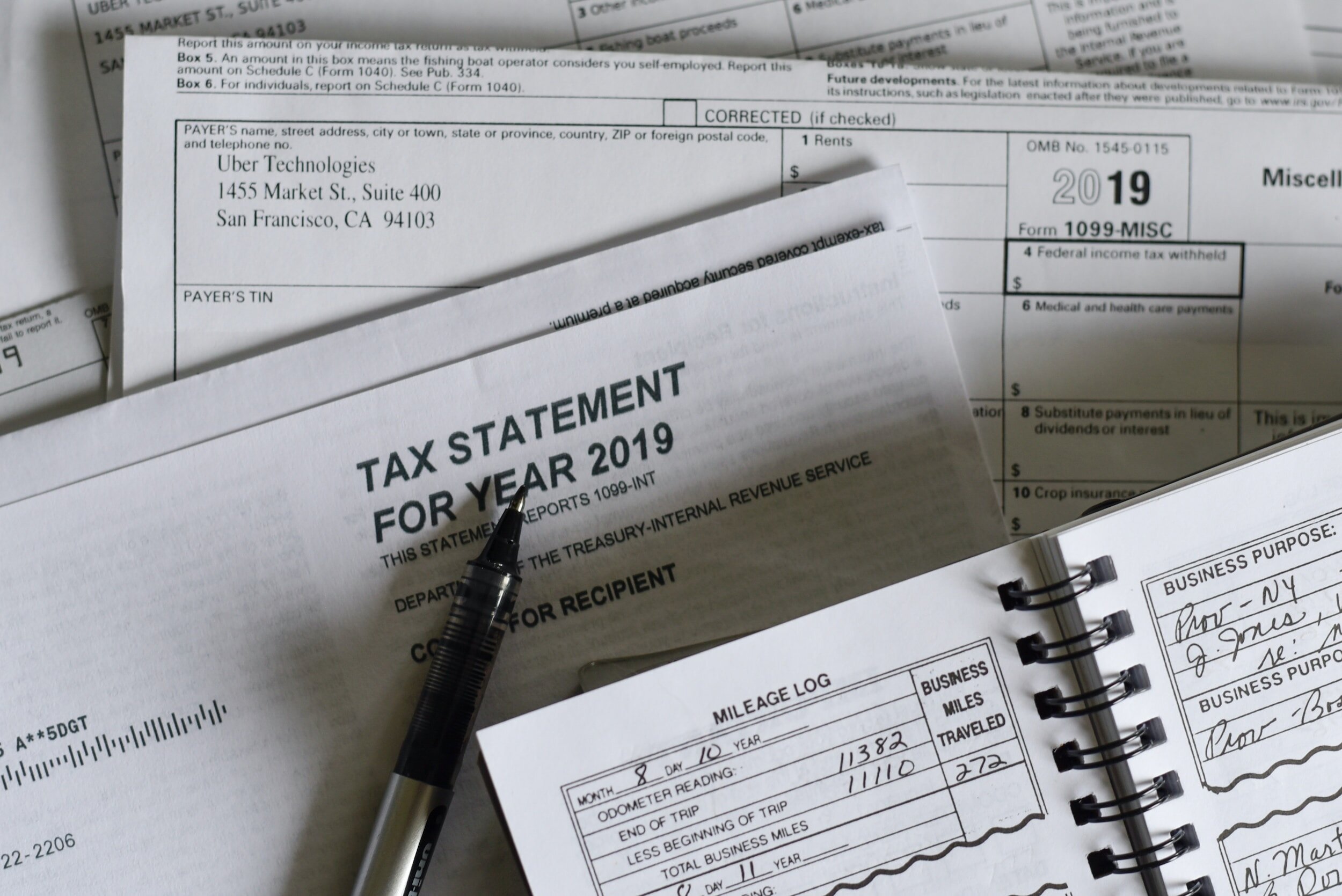

With regards to tax filing, our primary focus was to ensure our clients comprehended the reasons behind their tax filing obligations. It was crucial that they grasped the implications of not filing, as it could hinder their eligibility for various benefits and credits.

During that year, we also focused on delving into the impact of Trillium Benefit repayments on clients residing in TCHC units. While we acknowledged the necessity of these repayments, we were committed to breaking down the financial implications for our residents. This issue particularly affected seniors living in social housing, who faced an annual loss of between $500 and $700, coupled with an outstanding debt in the same range.

To mitigate the financial strain, we supported residents in gaining access to various government incentives, including increased GST, climate incentives and grocery rebates to alleviate the rising cost of living. Additionally, the introduction of the free dental care plan through the Canadian government was successful, with a substantial number of clients applying for it. We received specialized training to aid clients in applying for other benefits through the Toronto Hydro-Electrical Financial Assistance. We also supported clients with OAS, CPP, Disability Tax Credit, OSAP, WSIB, Social Assistance and ODSP applications.

Notable achievements included a surge in clients independently opening their ‘MYACCOUNT’ through CRA. During tax season, we emphasized the importance of this step, resulting in a significant number of clients taking the initiative themselves. This underscored the effectiveness of the FEPS model, which aims to empower clients to become self-sufficient and take control of their finances.